Garage Insurance

.

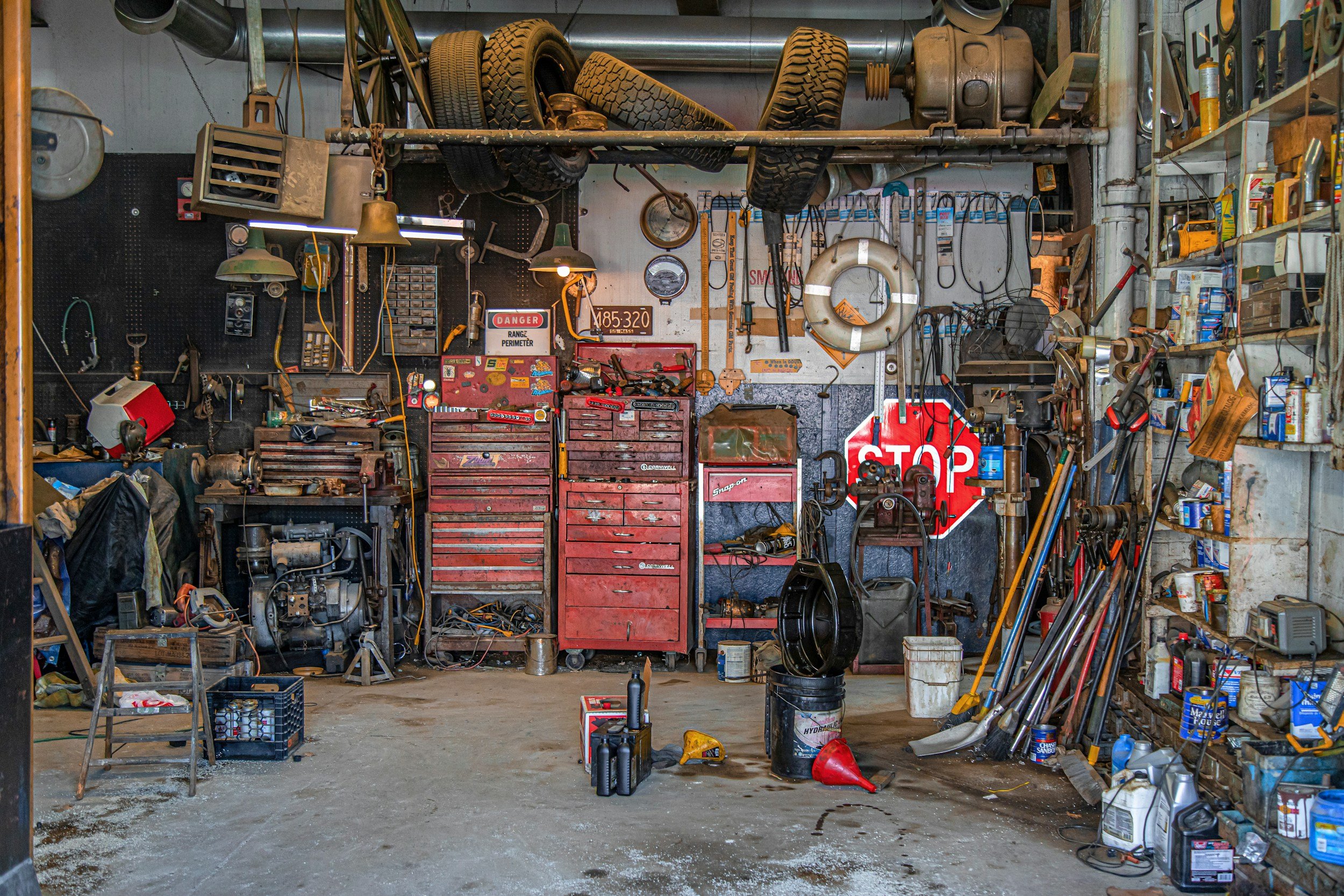

“Garage insurance is a specialized form of coverage designed to meet the unique needs of businesses that operate in the automotive industry. Whether you own a small auto repair shop, a car dealership, or a large-scale vehicle service center, garage insurance provides a protective shield against a wide range of risks associated with your business activities. In this detailed guide, we’ll explore the importance of garage insurance, the benefits it offers across different business sizes, and why it’s an essential component of your risk management strategy.”

What is Garage Insurance?

Garage insurance combines several types of coverage into one policy, specifically tailored to businesses involved in vehicle sales, servicing, repair, or customization. This type of insurance typically includes general liability insurance, which protects against third-party claims of bodily injury or property damage, and garage keepers liability, which covers damages to customer vehicles while in your care, custody, or control. Additionally, it may also offer coverage for tools, equipment, and other assets essential to your operations.

Importance of Garage Insurance for Your Business

-

Protection Against Legal and Financial Risks

Accidents can happen in any business setting, but the risks are particularly high in the automotive industry. From potential injuries on your premises to damages during vehicle repair or servicing, garage insurance ensures that your business is financially protected against claims that could otherwise be devastating.

-

Customization for Various Industries

Whether your business focuses on vehicle sales, auto repair, body work, or customization, garage insurance can be tailored to suit the specific risks and needs of your operation. This customization ensures that you’re not paying for unnecessary coverage while still being protected against the most relevant risks.

-

Benefits Across Different Business Sizes

For small enterprises, garage insurance is crucial for safeguarding against risks that could jeopardize their financial stability. Larger organizations, with more employees and customers, face even greater risks and thus, the broader coverage provided by garage insurance becomes even more vital. In essence, garage insurance scales with your business, providing peace of mind regardless of your operation’s size.

Why Every Auto Business Needs Garage Insurance

-

Comprehensive Coverage

Garage insurance offers a comprehensive safety net that includes liability protection, coverage for customer vehicles, and often, property and equipment coverage. This all-encompassing approach ensures that various aspects of your business are protected under one policy.

-

Risk Management

By covering a broad spectrum of risks, garage insurance is a key component of your overall risk management strategy. It not only protects your financial assets but also contributes to a safer working environment for your employees and customers.

-

Customer Trust

Having garage insurance demonstrates to your customers that you’re committed to protecting their property and providing quality service. This can enhance your business’s reputation and lead to increased customer trust and loyalty.

Recent News & Updates

-

Is My Business Covered in the Event of a Cyber Attack?

Small business owners are not exempt from the risk of a cyberattack. The loss of customer data is a financial disaster, and with cyber incursions becoming more common, and hitting even the largest companies, from banks to retails to online giants with extensive security, it is well worth ensuring your business has adequate cyber insurance.

-

5 Unconventional Businesses That Still Need Insurance

If you own a business, you need business insurance. No matter how unconventional your enterprise is, be assured, you have some exposure to risk. The following are unconventional businesses that still need insurance.

-

How Promoting Workplace Safety can Save You Money

No business owner wants to have injured an injured employee. Reducing the risk of accidents and injuries is a critical aspect of good management, in every industry. Employees who have been trained with customized worker safety programs are far less likely to be injured when performing the duties of employment – and file a claim with your workers’ compensation insurance provider. Every claim filed with your insurance provider will lead to increased premium costs, and in some industries, may lead to OSHA fines for violations of workplace safety standards.

Whether you're just starting out or looking to reassess your current insurance coverage, exploring garage insurance options is a step toward securing the future of your automotive business.

With its ability to be customized to your specific needs and the broad protection it offers, garage insurance is an investment in your business’s stability and growth.

Don’t wait for an accident or a lawsuit to think about your insurance needs. Contact an agent today to discuss how garage insurance can be tailored to fit your business. Protect your operation, your employees, and your customers with the right coverage. Get a quote for garage insurance and take the first step toward peace of mind and a more secure business future.